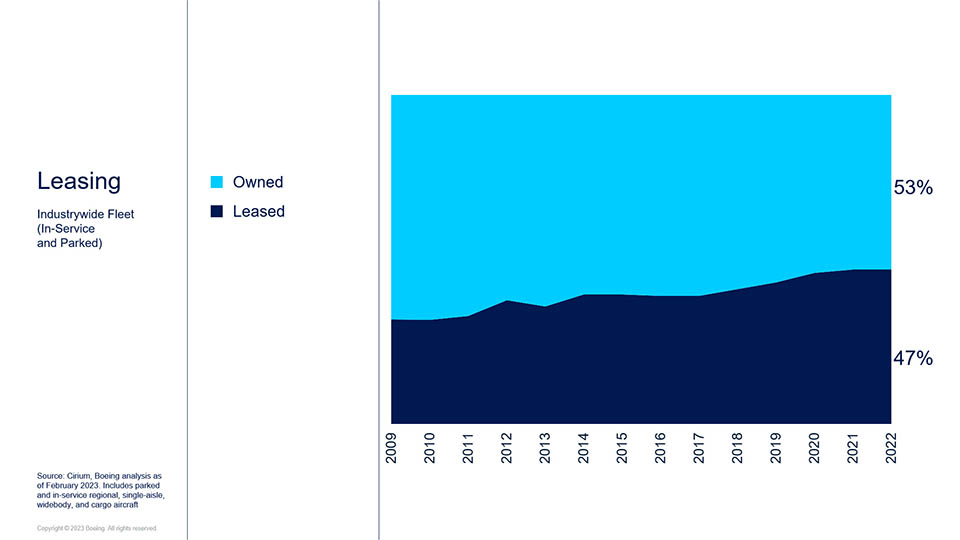

Aircraft lessors remain a key cornerstone of the overall aircraft finance ecosystem, supporting nearly half of the world’s fleet. With extensive knowledge and execution capability, the leasing channel is a proven funding platform for our customers. As the aviation sector continues to strengthen and operational cash flows recover, we expect that competition from in-house sources and other products will compete earnestly with the leasing channel.

Overview

The Boeing Commercial Aircraft Finance Market Outlook (CAFMO) is our annual review of aircraft financing trends over the past year, along with our view on the market environment ahead.

The 2023 CAFMO features a forecast for potential aircraft delivery financing outcomes for the year, reinstated on the back of favorable data following several years of industry recovery. While uncertainties in the geopolitical and economic environment prevent us from providing a more precise forecast, the 2023 CAFMO confirms that a number of the financing platforms are well-placed to support the expected growth in aircraft deliveries this year. Nevertheless, Boeing Customer Finance endeavors to ensure that support is readily available to our customers for end-to-end delivery financing across all geographies.

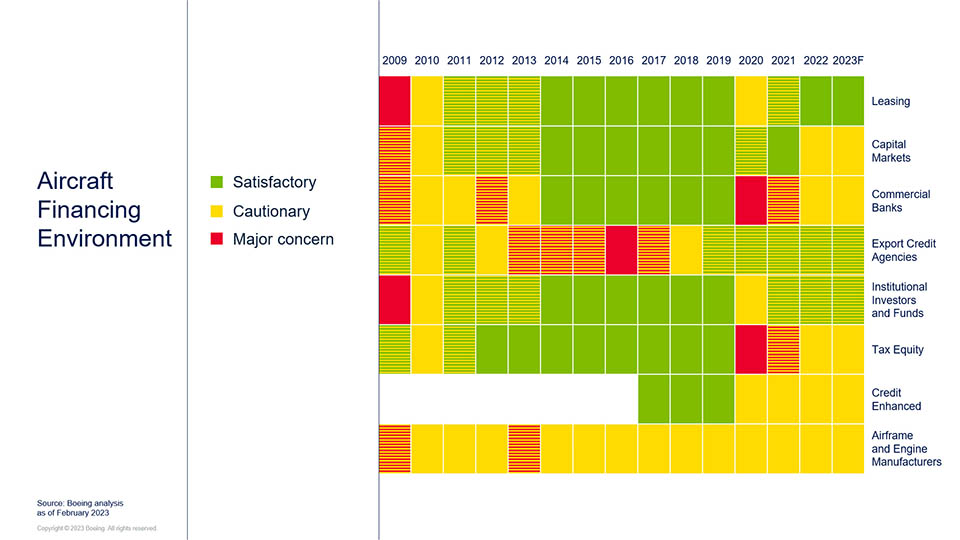

Positive trends within several financial products may warrant upward revisions to certain ratings later in 2023, subject to further supportive data points.

Positive trends within several financial products may warrant upward revisions to certain ratings later in 2023, subject to further supportive data points.

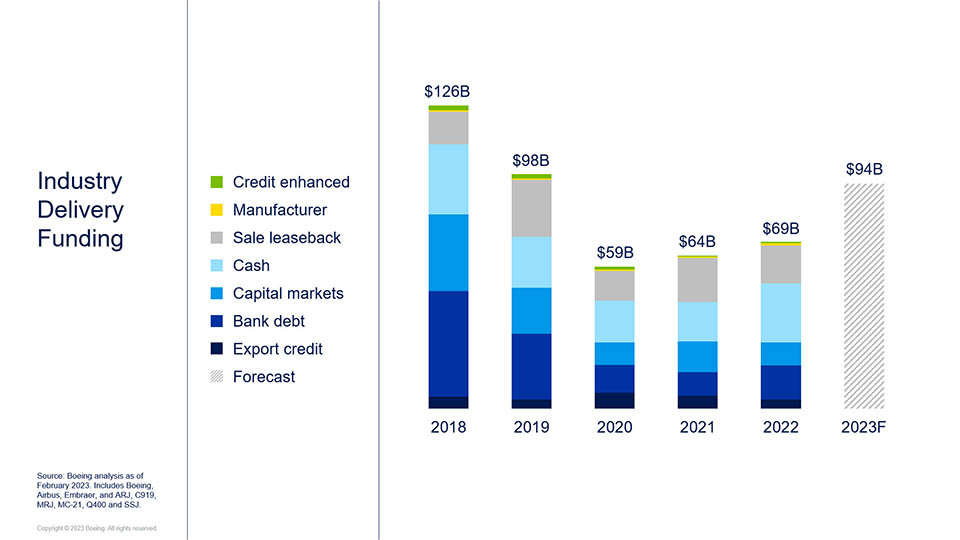

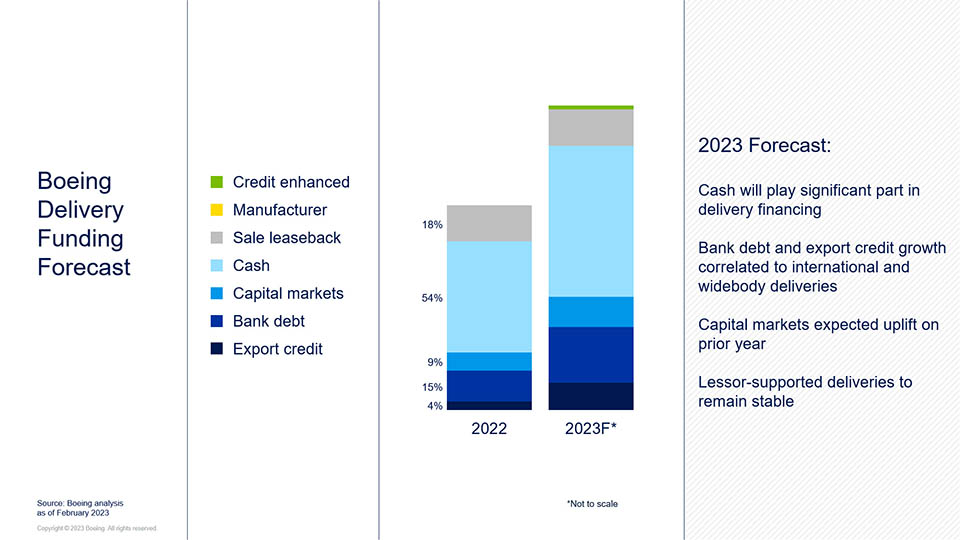

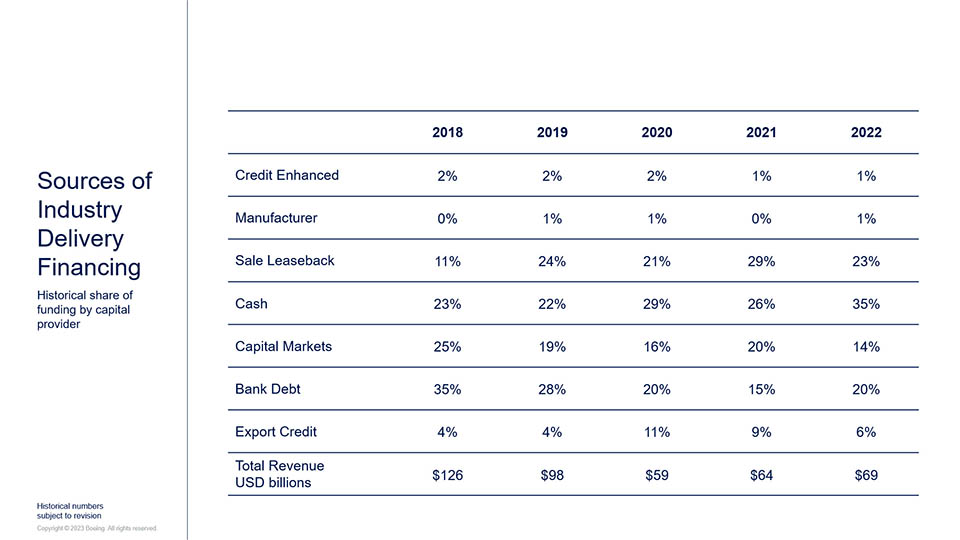

Industry delivery funding levels for 2022 reflected steady improvement in commercial aircraft demand. For 2023, with production increases and the reopening of certain regional markets, we forecast financing needs to reach near pre-pandemic levels.

Industry delivery funding levels for 2022 reflected steady improvement in commercial aircraft demand. For 2023, with production increases and the reopening of certain regional markets, we forecast financing needs to reach near pre-pandemic levels.

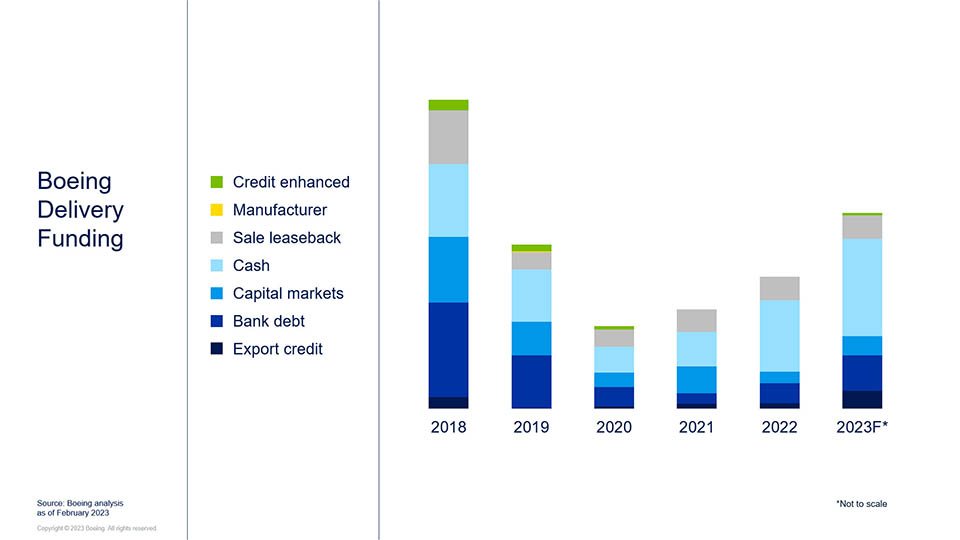

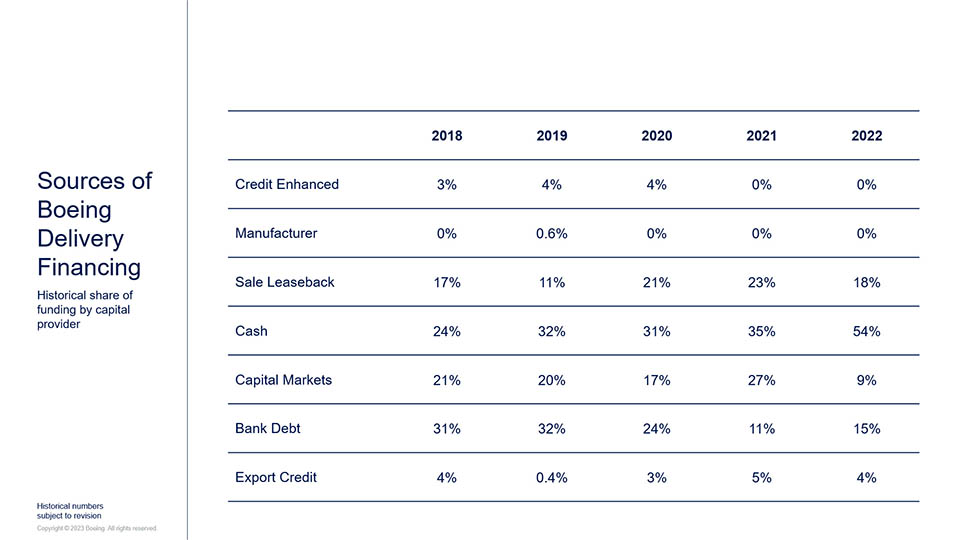

In 2022, Boeing deliveries increased nearly 50% from 2021 levels. The majority of Boeing aircraft were funded with cash as a result of our customer base’s strong operational performance and de-leveraging efforts.

In 2022, Boeing deliveries increased nearly 50% from 2021 levels. The majority of Boeing aircraft were funded with cash as a result of our customer base’s strong operational performance and de-leveraging efforts.

While cash funding will likely remain elevated in 2023, the total addressable financing opportunities for new Boeing aircraft will expand.

While cash funding will likely remain elevated in 2023, the total addressable financing opportunities for new Boeing aircraft will expand.

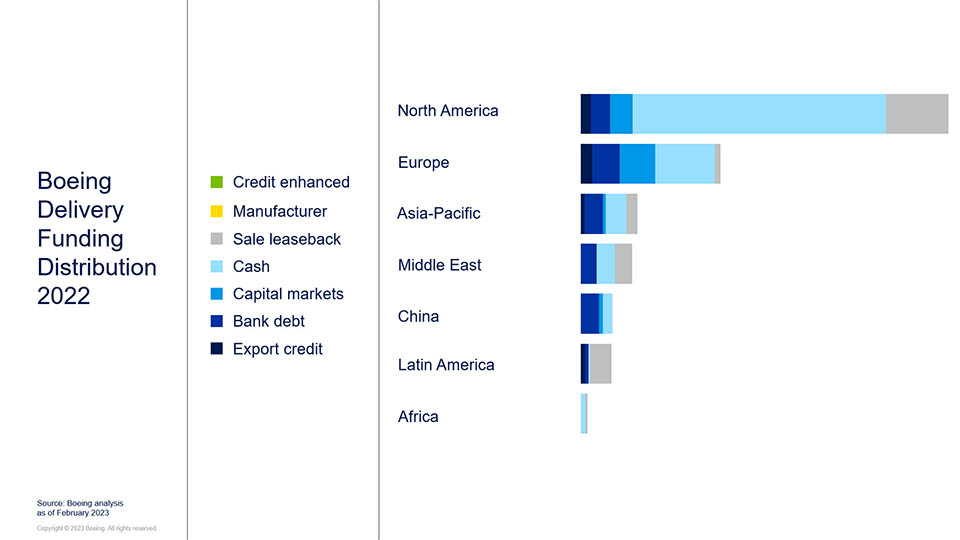

While over half of Boeing aircraft in 2022 were delivered to North American customers, we expect 2023 to achieve improved diversity in customer deliveries.

While over half of Boeing aircraft in 2022 were delivered to North American customers, we expect 2023 to achieve improved diversity in customer deliveries.

- Positive trends within several financial products may warrant upward revisions to certain ratings later in 2023, subject to further supportive data points.

- Industry delivery funding levels for 2022 reflected steady improvement in commercial aircraft demand. For 2023, with production increases and the reopening of certain regional markets, we forecast financing needs to reach near pre-pandemic levels.

- In 2022, Boeing deliveries increased nearly 50% from 2021 levels. The majority of Boeing aircraft were funded with cash as a result of our customer base’s strong operational performance and de-leveraging efforts.

- While cash funding will likely remain elevated in 2023, the total addressable financing opportunities for new Boeing aircraft will expand.

- While over half of Boeing aircraft in 2022 were delivered to North American customers, we expect 2023 to achieve improved diversity in customer deliveries.

Funding Distribution by Region

- North America

- Asia Pacific

- Europe

- China

- Middle East

- Latin America

- Africa

North America

Cash funding was heavily favored by our North American customers in 2022 as a result of their strong cash flow positions on the back of robust operational performance.

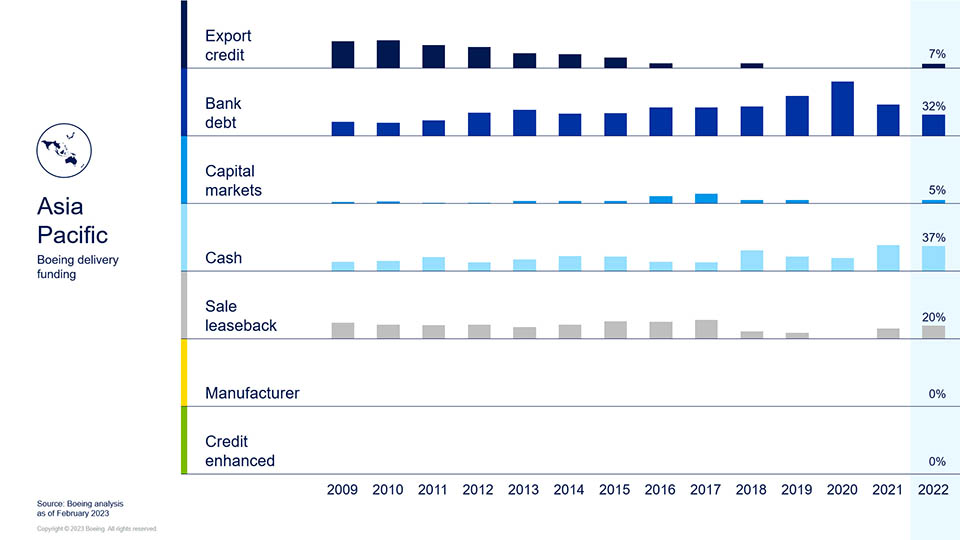

Asia Pacific

While deliveries to Asia Pacific remain subdued, most of those customers had readily available access to bank debt and cash resources.

Europe

Although historically a region with the most balanced mix across the funding sources, in 2022 European customers opted to use more cash.

China

Deliveries to China were limited to Chinese lessors and cargo aircraft, funded primarily by domestic banks.

Middle East

Middle East delivery funding was balanced across cash, sale and lease-back arrangements and bank debt.

Latin America

Carriers in Latin America relied primarily on sale and lease-back arrangements for their deliveries, while some tapped into export credit and commercial debt.

Africa

Africa’s deliveries in 2022 were predominantly self-funded or via sale and lease-back arrangements.

Financing Sources

Leasing

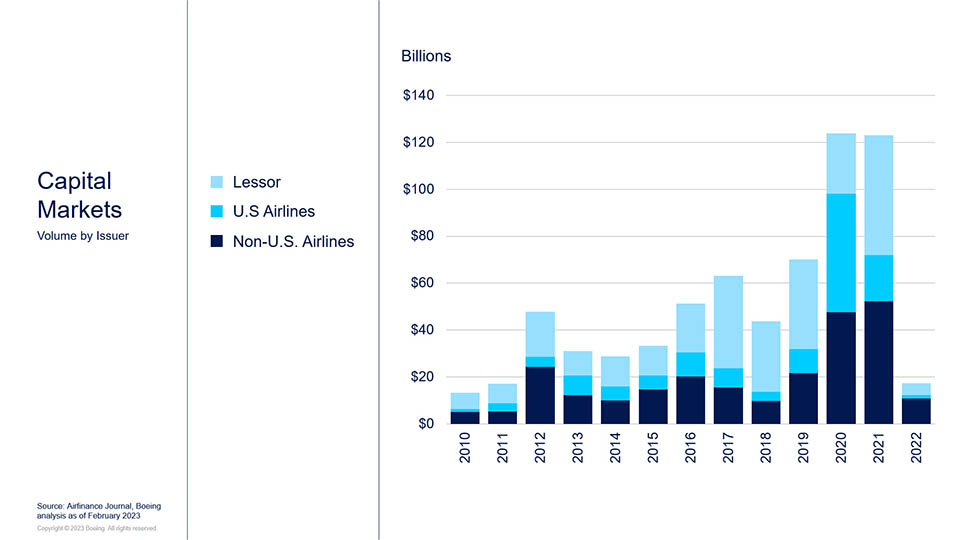

Capital markets

Prior year activity in the capital markets was remarkably subdued in comparison to the heightened activity recorded in the peak COVID-19 era, which in turn may have reduced the need to print again in 2022. On a larger scale, geopolitical tensions, inflationary concerns and the rising interest rate environment put issuances on hold. These conditions persist into 2023, though there has been some pickup with recent issuances this year thus far.

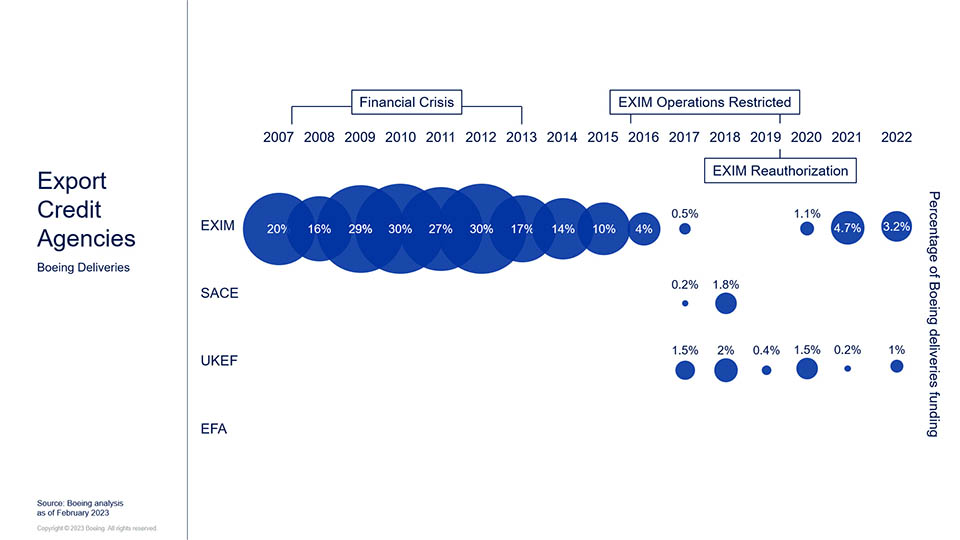

Export credit agencies

Export credit agencies (ECAs) supported over 4% of Boeing deliveries in 2022. ECAs are an important financing alternative for our customers, especially in markets where commercial lending may face challenges. We expect ECA-backed financing to coincide with the resumption of deliveries to recovering regions. Boeing works with ECAs worldwide.

Other Commercial Solutions

The aircraft finance industry’s proven ability to innovate, adapt and execute solutions has proliferated a host of product offerings to fill the needs of customers. These sources of financing have been validated and are well-positioned to capitalize on increased deliveries.

Methodology

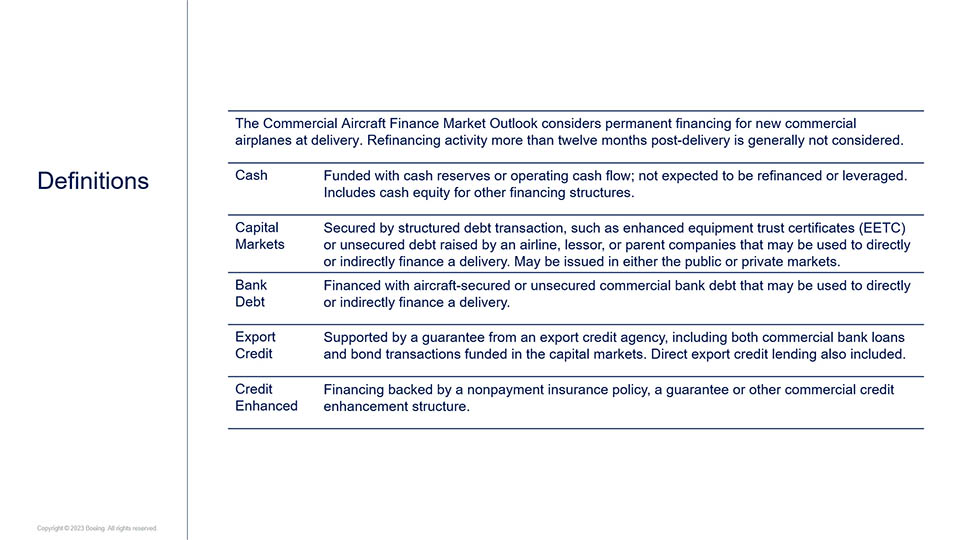

Boeing Capital created the Commercial Aircraft Finance Market Outlook (CAFMO) to provide an analysis of the sources of financing for new commercial airplane deliveries (for aircraft 90 seats or above).

- Image 1

- Image 2

- Image 3