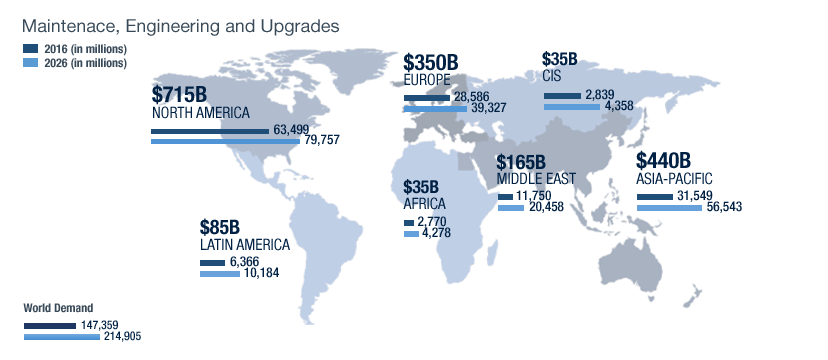

Maintenance, Engineering and Upgrades: 2017 - 2026

The tasks and services associated with upgrading, maintaining and restoring airworthiness of aircraft make up nearly 70% of our $2.6T served market growing at 3.8% annually.

Aircraft and fleet owners across the government and commercial market segments can perform these services in-house or outsource some or all to maintenance repair and overhaul (MRO) providers. There is a growing trend for airlines, particularly start-ups or low-cost carriers (LCC), to forego the expense of setting up full-service maintenance departments, opting instead to outsource some or all of these services. Government customers in general prefer to partner, retaining responsibility and know-how for the sustainment of their platforms and utilizing services providers for specific purposes.

Commercial airline customers continue to migrate tasks into overnight maintenance checks in order to minimize time out of service, citing examples like increasing uptake of component support programs, migrating work tasks from heavy checks to line maintenance, increasing the use of inventory pooling, embracing data and analytics (for both retrospective analysis and predictive maintenance), and increasing the use of maintenance planning tools. Government customers are seeing the benefits of these practices and are considering how to apply them in military and defense fleets.

MROs themselves are also becoming more efficient, introducing mobile devices that give mechanics and engineers electronic access to technical manuals, task cards, and e-signatures. These tools tighten up the work flow and speed turn-around time, reducing the time in shop.