Airlines around the world boosted air cargo capacity in response to global transportation needs during the COVID-19 pandemic. With global supply chain challenges easing and recovery of long-haul international passenger networks progressing, the industry is now shifting focus to the evolving needs of air cargo demand and networks in the post-pandemic years ahead.

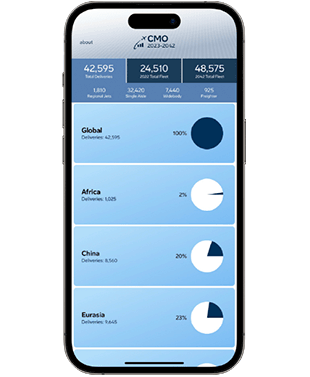

Boeing’s World Air Cargo Forecast (WACF) is a biennial supplement to the Commercial Market Outlook, focused on a comprehensive and long-term view of the air cargo market. The forecast offers in-depth analysis of global air trade markets including trends, regional market developments, and the world’s freighter fleet needs.