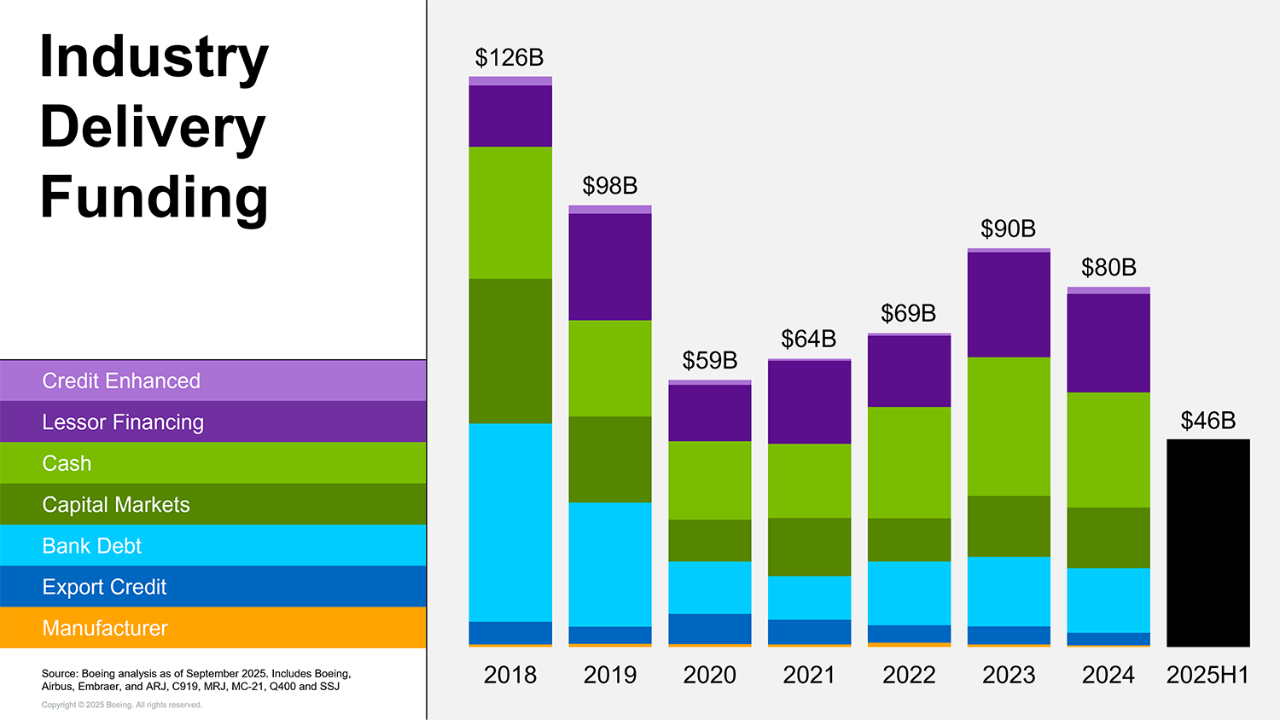

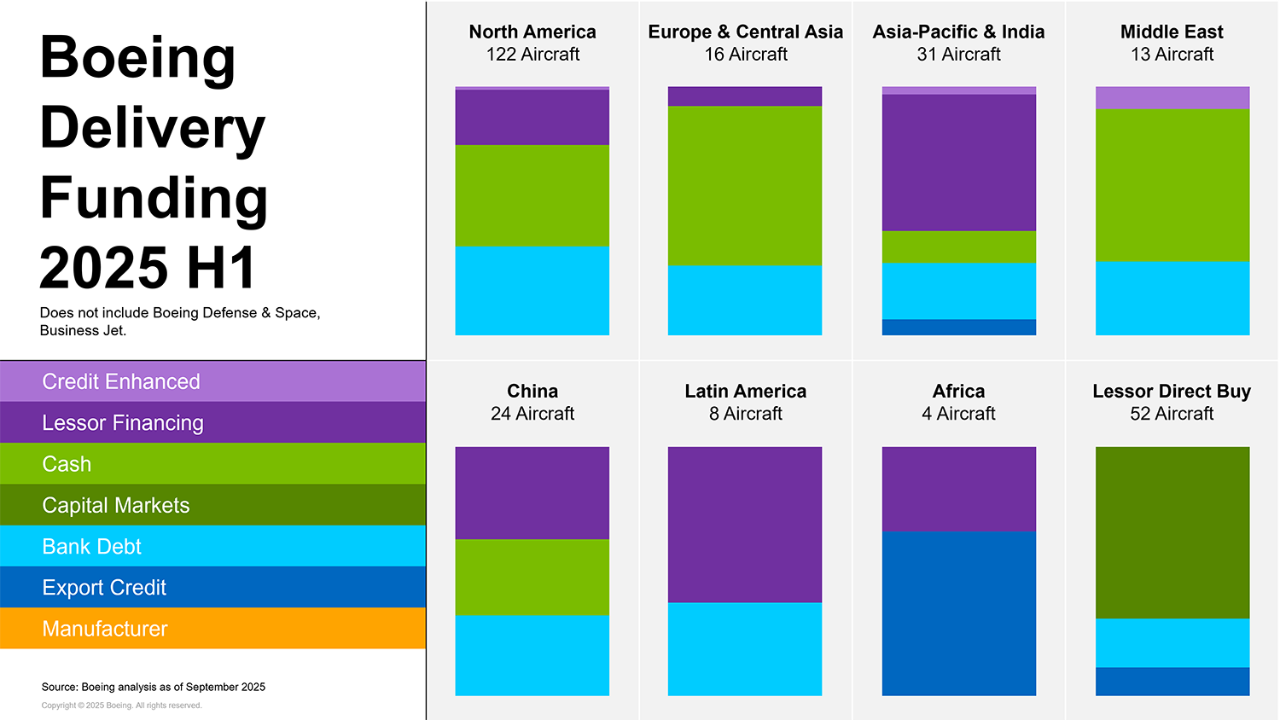

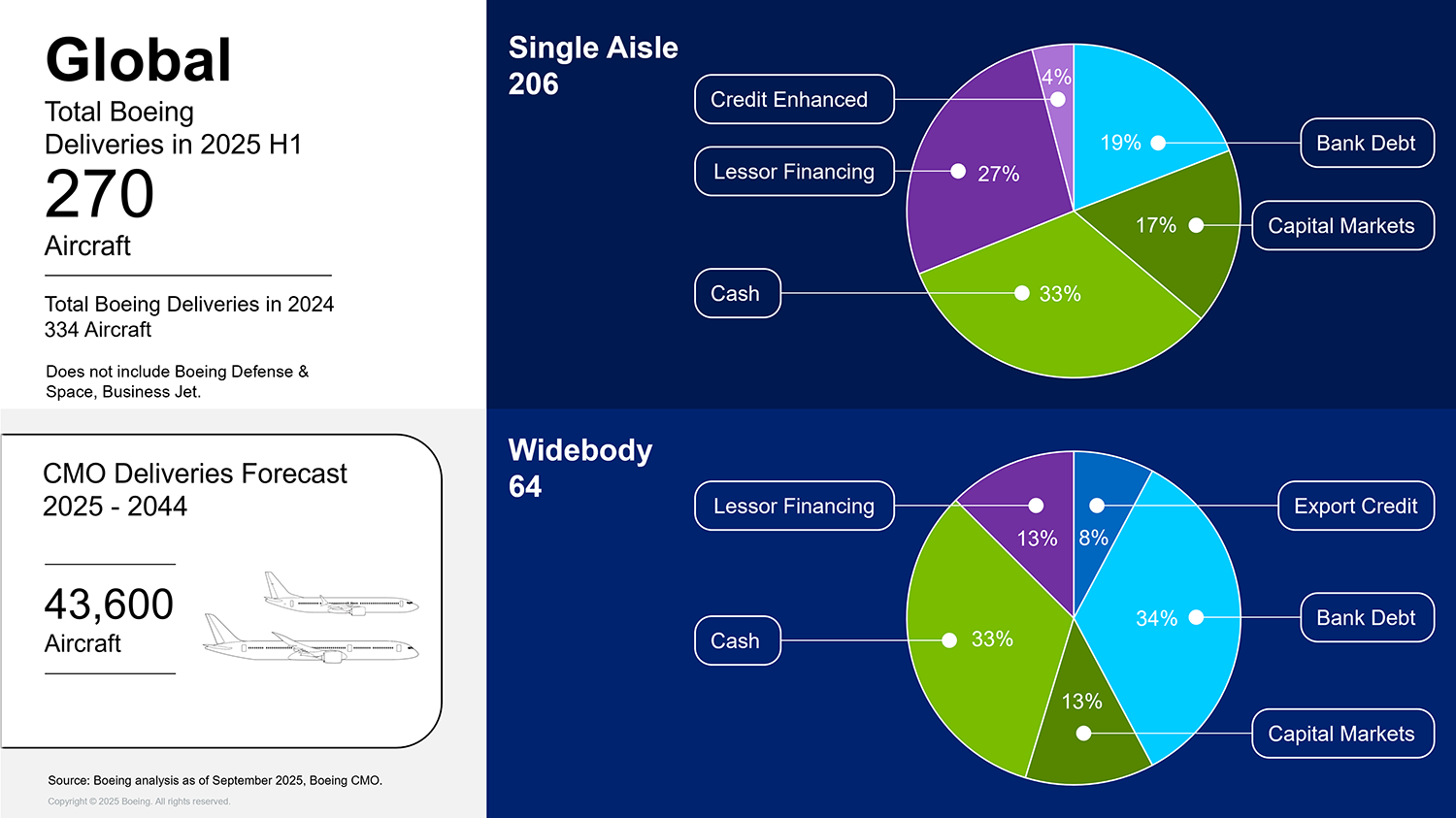

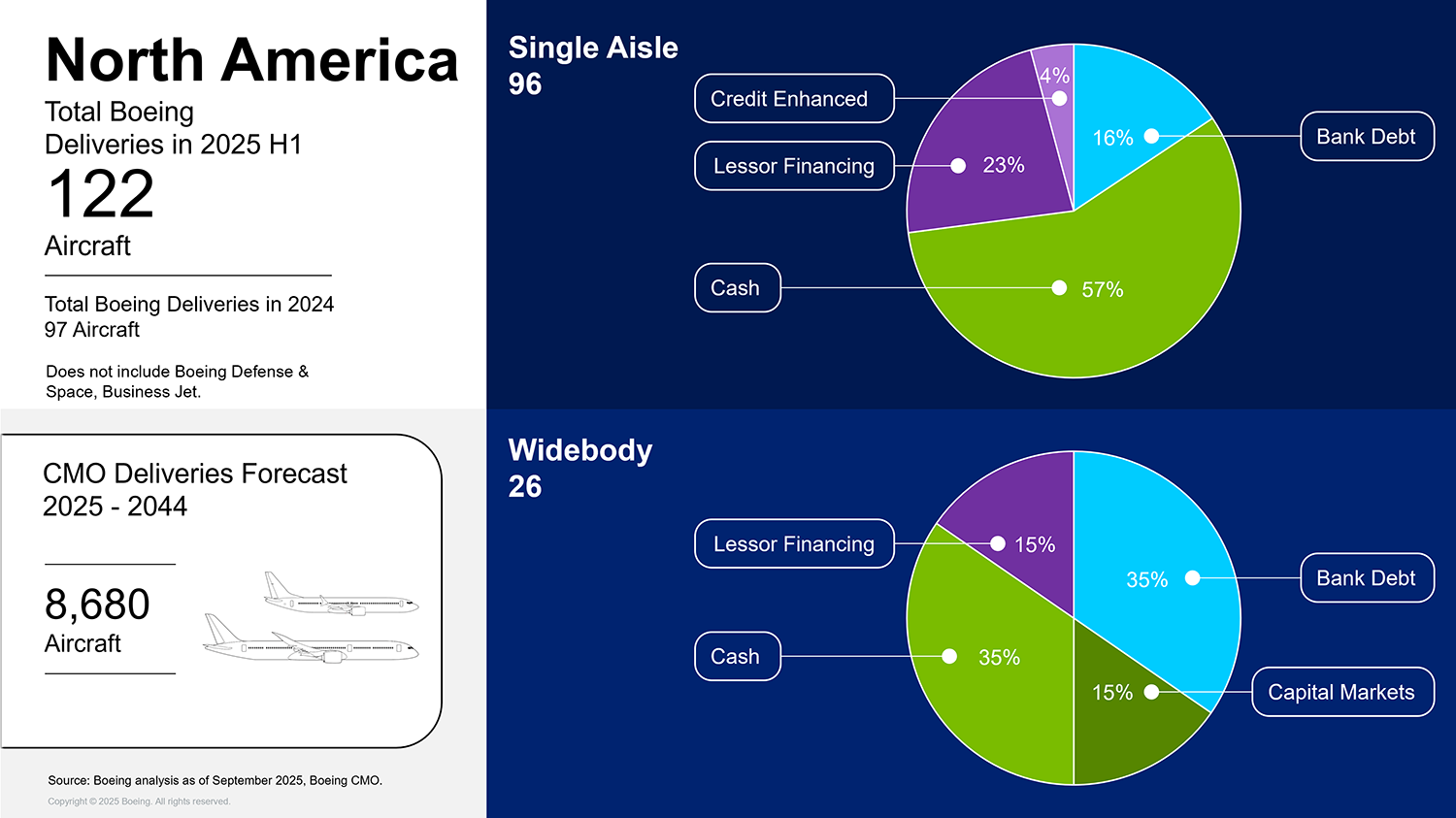

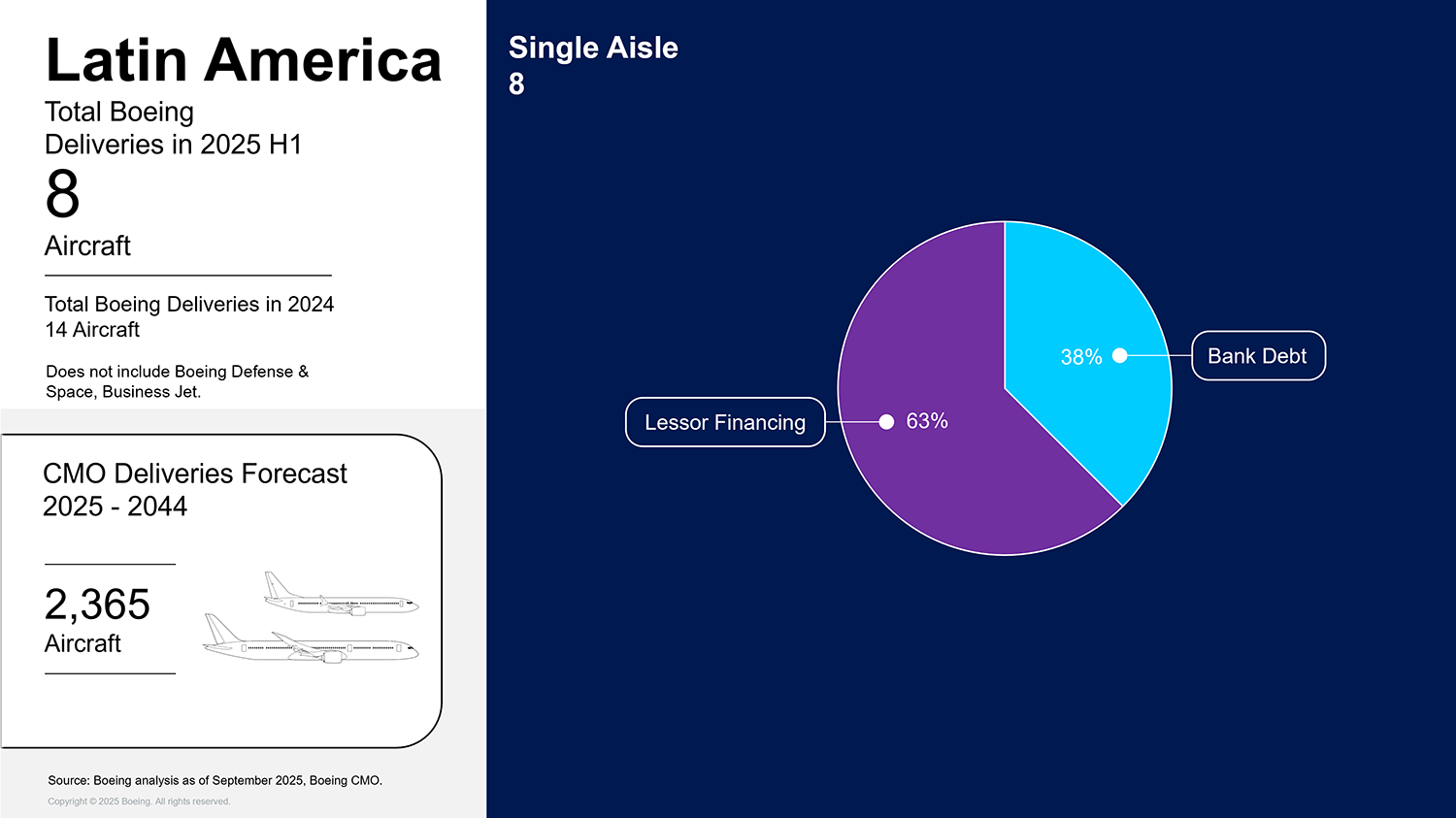

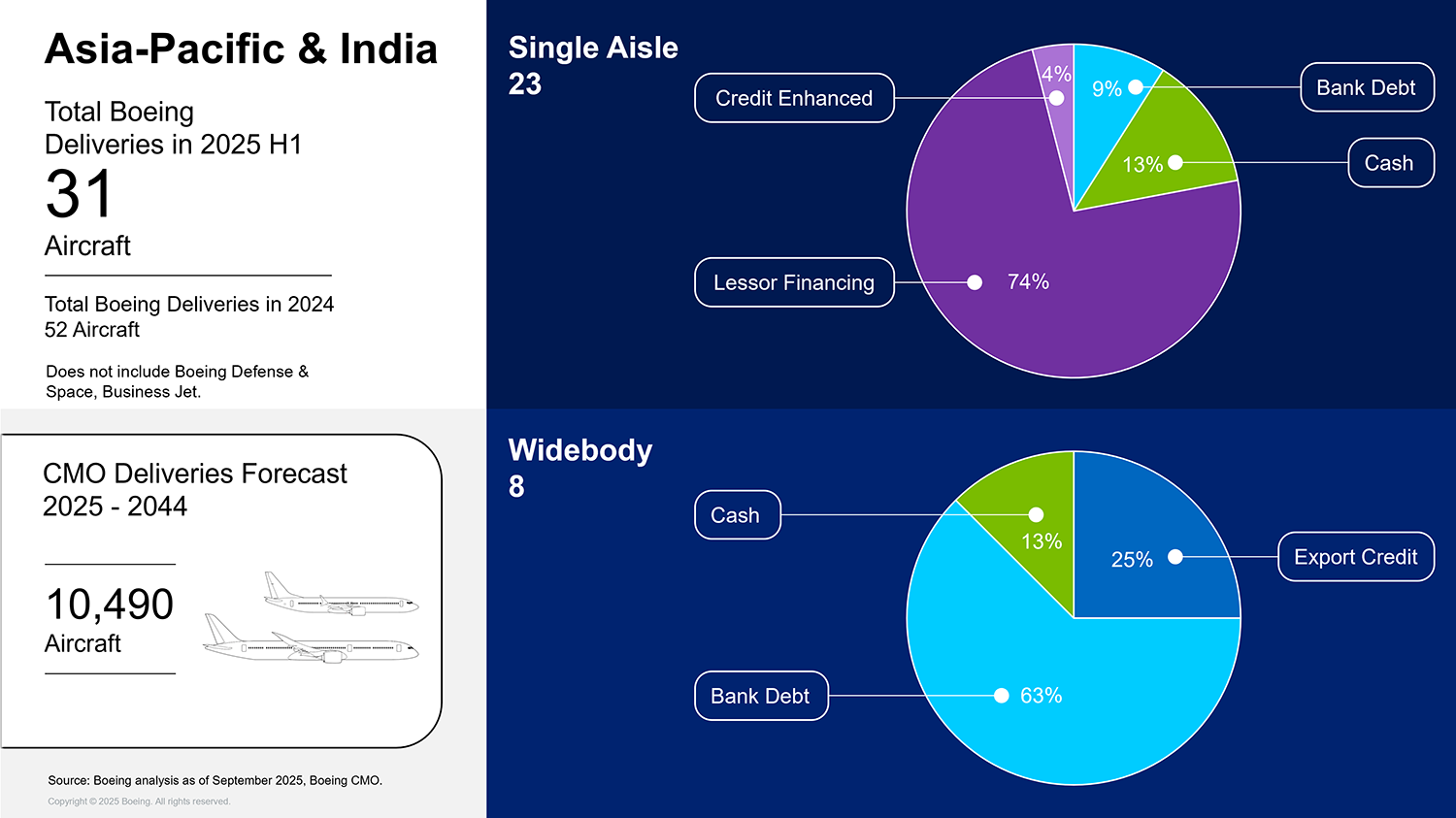

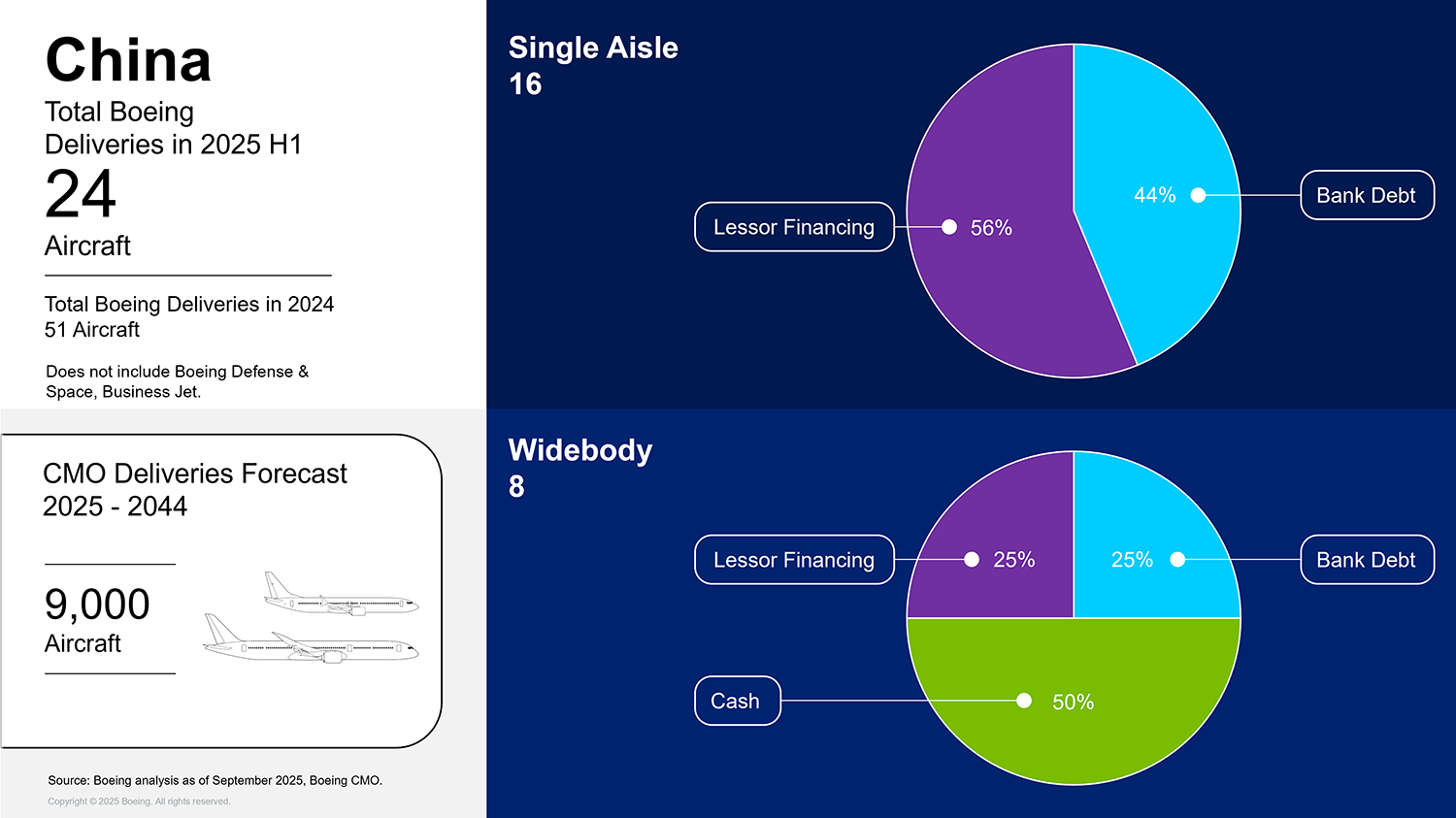

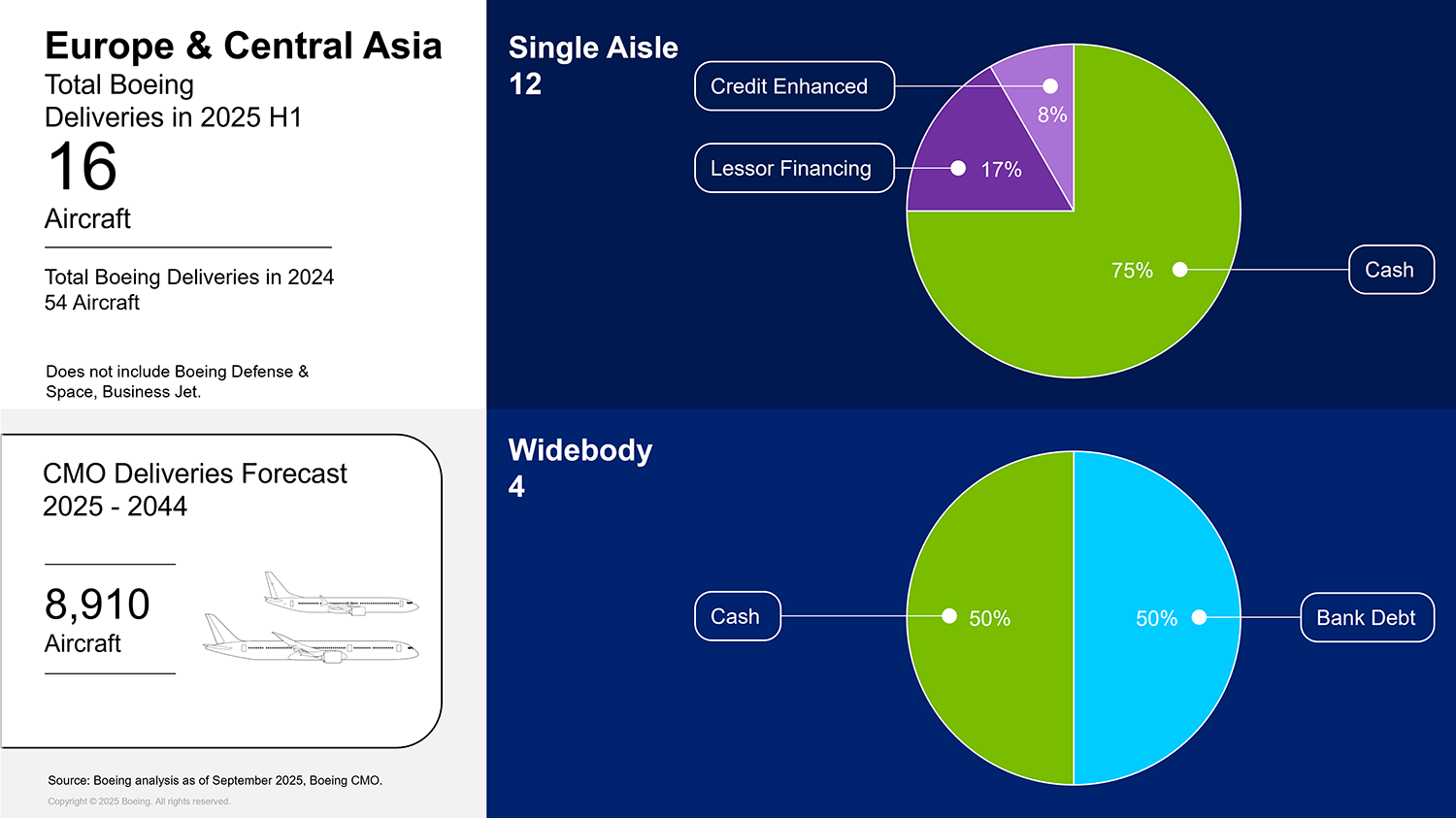

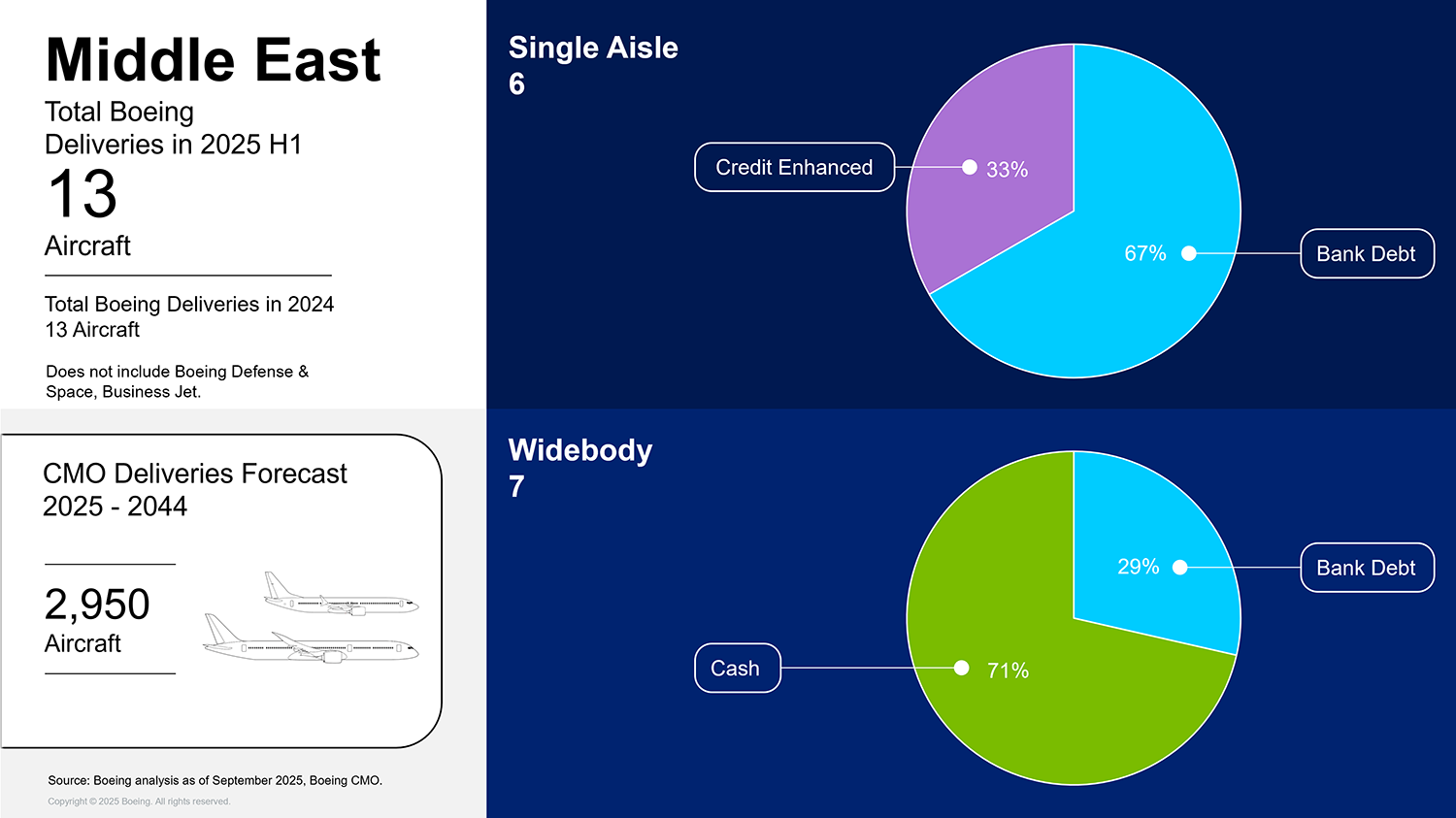

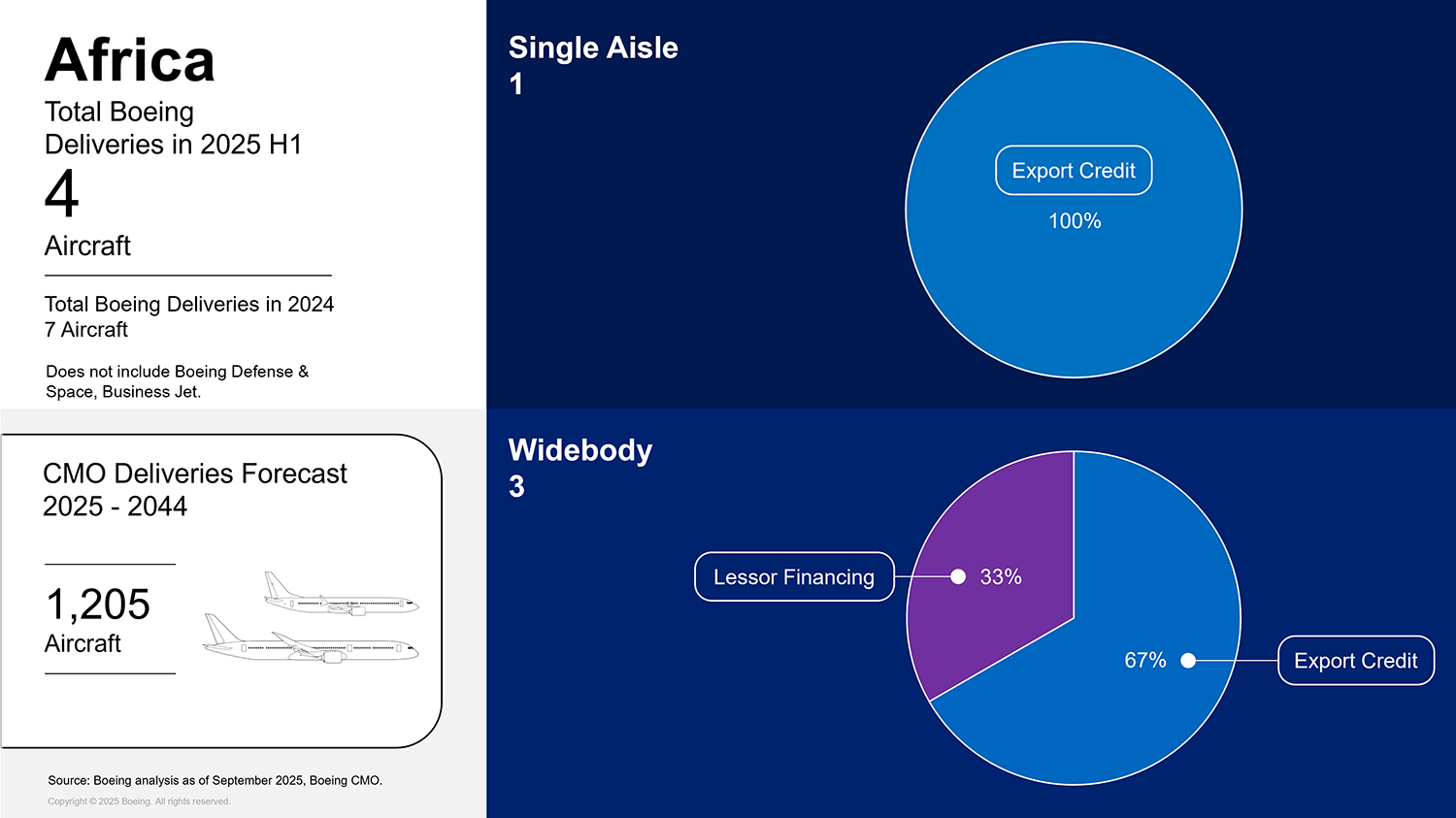

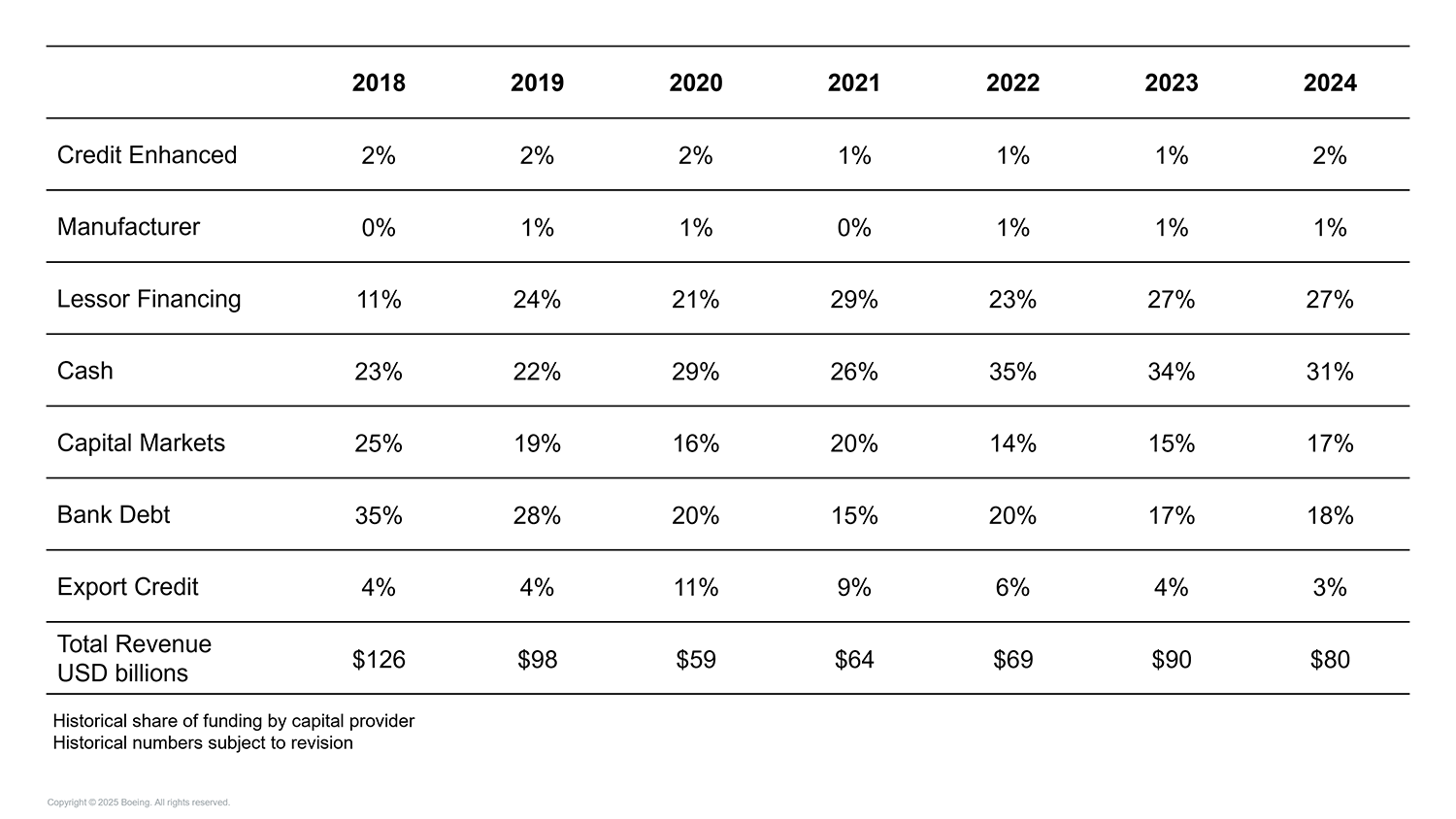

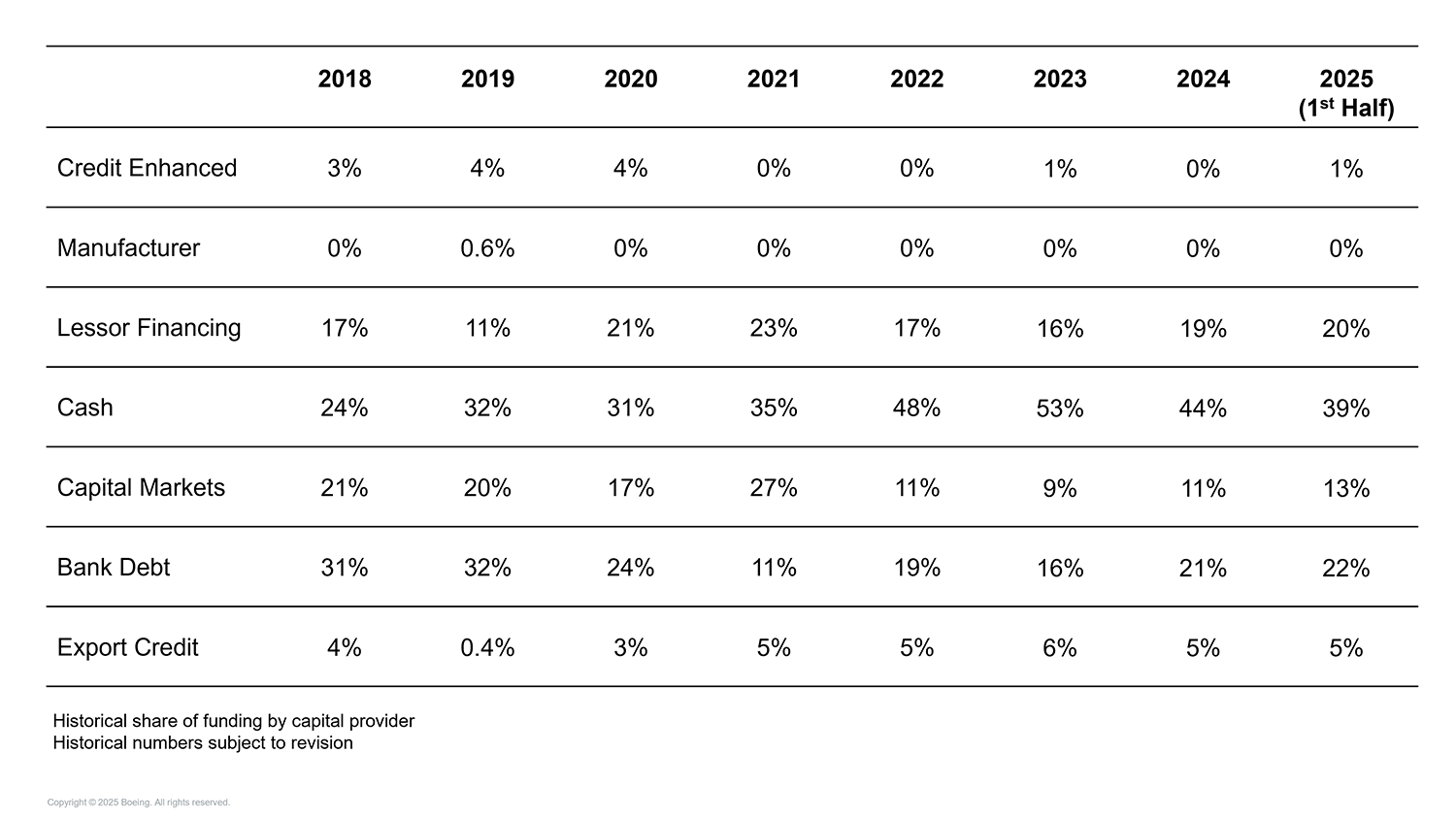

With a higher gross level of deliveries compared to H1 2024, we have seen some subtle changes in financing trends during the first half of this year compared to the preceding year, with our health check reflecting a broadly positive financing status quo for our airline customers. Regional discrepancies in availability of financing sources are, however, still evident and are ostensibly underpinned by credit quality differentiators; this marker is consistently the single most prominent selection criteria for the majority of international financiers.

We continue to observe a highly competitive new aircraft delivery financing market and that has often resulted in pricing dislocation in a number of transactions. That status will be closely watched in relation to new aircraft delivery flow, particularly in relation to wide-body aircraft, which is likely to impact price setting into ’26 and ’27.

The strengthening of rule of law standards by certain countries, which affords a more benign financing environment, is enabling a “risk-on” approach by those international financiers seeking to grow their new customer base. That is a welcome development that ensures that airlines are offered the broadest range of financing solutions for their aircraft deliveries. We recognize that this is an on-going process that requires continued cross-industry support.

In summary, we see a funding market that is showing adequate depth and appetite for new aircraft delivery financing. There is, though, a need to be vigilant to the wider macro-economic changes and to continue to reinforce the legal “level playing fields” that enable financiers to successfully transact on a global basis under their risk and reward models. As delivery volumes continue to recover, more capital will be needed for our customers and that will require all financing tools being fully available on a global basis, as well as new product development that can support these higher transaction volumes.